Ex-Federal Reserve chair says US economy is heading toward period of stagflation for first time since1970s: CEO of Goldman Sachs says risk of America falling into a recession ‘is very, very high’

The former head of the Federal Reserve says the US is heading toward a period of high inflation and low economic growth as the head of Goldman Sachs and other global banks warn that a recession is coming.

Ben Bernake, who led the Fed through the 2008 financial crisis, says ‘stagflation’ may be on the horizon.

‘Even under the benign scenario, we should have a slowing economy,’ he told the New York Times as average prices are up by 8.3 percent from last year.

And inflation’s still too high but coming down. So there should be a period in the next year or two where growth is low, unemployment is at least up a little bit and inflation is still high. So you could call that stagflation,’ Bernake added.

Stagflation, a term coined in the 1960s, refers to low economic growth combined with high unemployment and high prices.

The last time the US went through such a period was in the 1970s after an oil ‘supply shock.’

The Covid-19 pandemic led to a similar shock in terms of labor and production, as factories paused their assembly lines and companies laid off workers in droves.

The Fed tried to manage the shocks by lowering interest rates to encourage borrowing and spending, which resulted in skyrocketing prices that the central bank is now trying to rein in by raising rates again. The belt-tightening could trigger a recession in of itself.

Meanwhile, the chairman of Goldman Sachs says the risk of the US falling into a recession is ‘very, very high.’

Bernake, 68, was nominated to head up the Federal Reserve by President George W. Bush.

The economist and MIT graduate served as chair of the central bank from 2006 to 2014.

He warns that a period of ‘stagflation’ may be coming soon.

Stagflation is when high prices and high unemployment meet low economic growth, according to The Conversation.

Economists use three variables to measure it: gross domestic product (the market value of all goods and services made within a country) unemployment and inflation (a decrease in the buying power of money.)

In the 1970s, oil-producing nations pushed prices up. Countries like the US that import a lot of oil suffered recessions and inflation.

The price of crude oil doubled from 1973 to 1975. Unemployment went from 4.6 percent in 1973 to 9 percent in 1975.

The cycle repeated itself a few years later. The consumer price index rose to 11.1 percent in 1974 and was back up even higher at 13.5 percent in 1980.

Th economy was officially in recession from 1969 to 1970 and 1973 to 1975, according to Investopedia.

Before that, it was believed that high inflation and high unemployment were not possible at the same time.

Economists now believe that a ‘negative supply shock’ can cause that. Such a shock happens when a crucial good, such as energy or labor, is suddenly in short supply.

The US underwent such a shock during the pandemic. Over the last two years, people lost their jobs, goods and services stopped being produced at the same rate and people collected massive unemployment benefits.

Bernake says the shock delayed production on his own upcoming book, ’21st Century Monetary Policy: The Federal Reserve From the Great Inflation to Covid-19.’

‘Given supply-chain disruptions, this book took six months to go from final manuscript to appearing in the store,’ he said.

The Federal Reserve, which he led for eight years, maintained interest rates at near-zero during much of the pandemic in order to increase borrowing and spending. The move has likely contributed to surging prices.

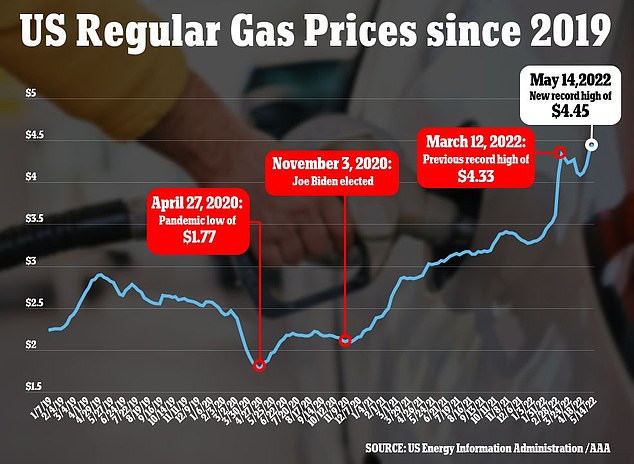

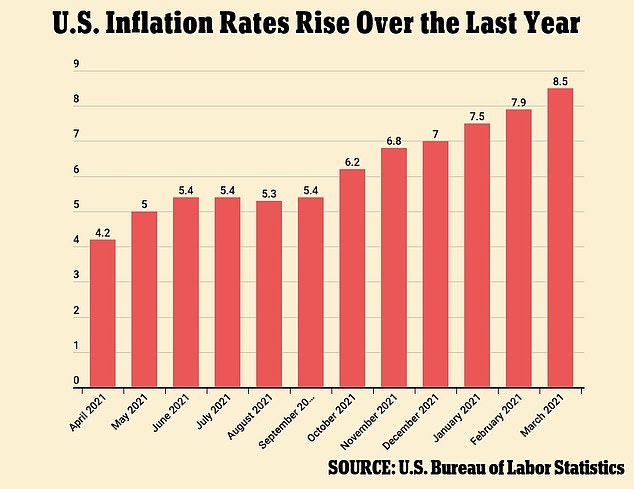

Inflation in the US hit 8.3 percent in April, falling slightly from the four-decade high it reached in March and breaking a streak of seven consecutive monthly increases in the annual rate of price increases.

The latest inflation report marks a mixed bag of news for consumers, showing that grocery prices are rising at their fastest annual rate in 42 years and flashing other signals that inflation is becoming more entrenched.

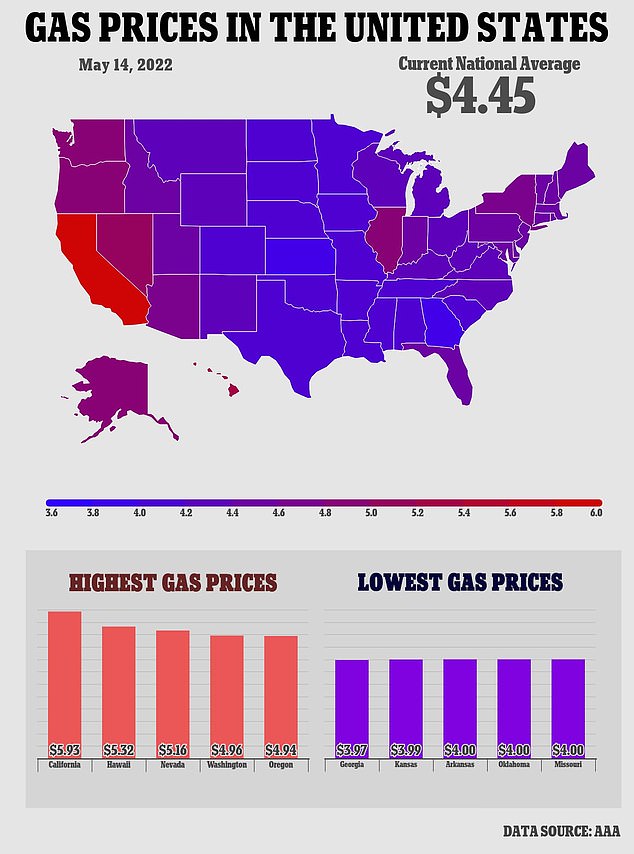

Gas prices have also soared, reaching an average of $4.48 per gallon on Monday, per the AAA.

Unemployment, however, has gone back to pre-pandemic levels, with new claims for the week ending April 30 falling by 44,000 from the previous week to 1,343,000. That’s the fewest since January 3, 1970.

Still, Bernake believes that ‘stagflation’ could happen.

He’s also concerned about the Fed’s credibility as it deals with the unusual economic circumstances of the past two years, given that inflation can quickly become a political wedge issue.

‘The difference between inflation and unemployment is that inflation affects just everybody,’ he told the Times.

‘Unemployment affects some people a lot, but most people don’t respond too much to unemployment because they’re not personally unemployed. Inflation has a social-wide kind of impact.’

On Sunday, Goldman Sachs chairman Lloyd Blankfein warned that the US is on its way to a recession.

Read full article: